In the present old age, managing payroll unequivocally and capably is central for any business. One of the main gadgets for this task is a payroll deductions online calculator. This device streamlines payroll taking care of, ensuring that all deductions are not entirely set in stone and predictable with current rules. With different decisions available, picking the best payroll deductions online calculator for your business can be a mind-boggling endeavor. This article gives a thorough manual for help you with picking the right gadget, solidifying key features to look for and the benefits of using a payroll calculator.

Understanding Payroll Calculators

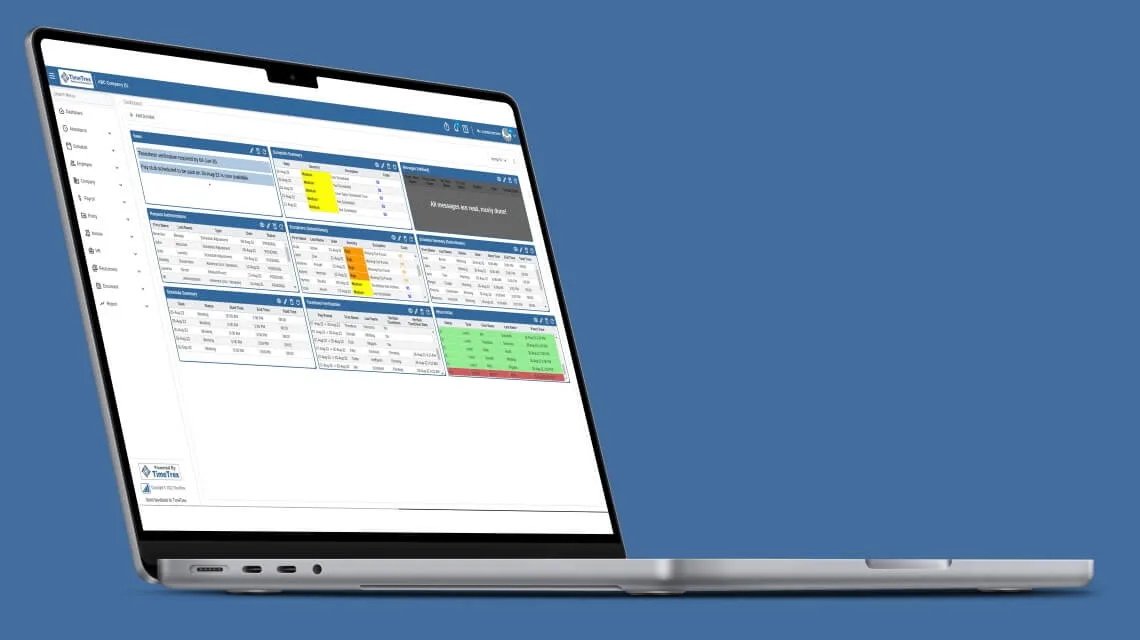

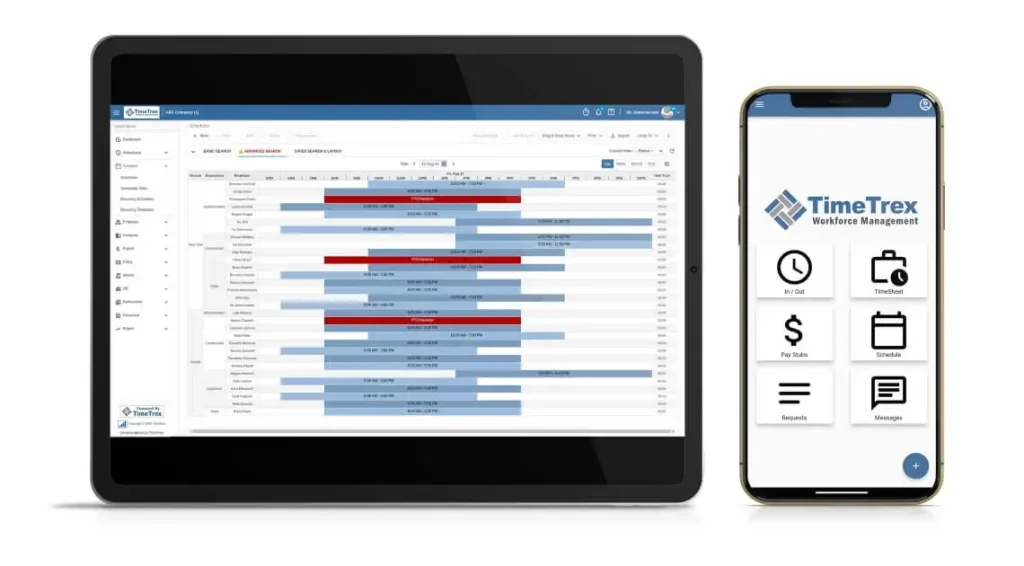

Before diving into how to pick the best payroll deductions online calculator, it’s crucial to understand what a payroll calculator is and how it works. A Payroll Calculator is a tool designed to compute employee compensation by accounting for various deductions and responsibilities. These deductions typically include federal taxes, government-supported retirement, Medicare, retirement contributions, and other voluntary or mandatory withholdings. By automating these calculations, a payroll calculator ensures accuracy and compliance, reducing the risk of errors that could lead to legal issues or employee dissatisfaction. For more information on reliable payroll solutions, visit Timetrex.

Key Features to Look For

When evaluating different payroll calculators, certain features are essential to ensure the tool meets your business needs. One of the first features to consider is customization. Your business might have specific deduction requirements or benefits that need to be accommodated. A good payroll deductions online calculator should allow you to customize settings for various types of deductions, ensuring that it can handle your unique payroll structure.

Another pivotal element is constant updates. Charge regulations and derivation rates as often as possible change, and it’s indispensable that your calculator mirrors these progressions right away. A payroll calculator with ongoing updates guarantees that your deductions are generally precise and consistent with the most recent guidelines. This component forestalls blunders and dodges the requirement for manual updates, saving time and decreasing the gamble of errors.

Integration capabilities are also important when choosing a payroll calculator. The tool should seamlessly integrate with your existing HR or accounting software. This integration helps streamline the payroll process by synchronizing data across systems, reducing manual entry, and minimizing errors. Ensure that the payroll calculator you choose supports integration with the software your business already uses.

User-friendliness is another critical factor. A Paycheck Calculator with an intuitive interface makes it easier for HR professionals and payroll administrators to use the tool effectively. Look for a calculator that offers a straightforward design and clear instructions, which will facilitate smooth operation and minimize the learning curve for new users.

Benefits of Using a Payroll Deductions Online Calculator

Using a payroll deductions online calculator offers different benefits that can in a general sense impact your business errands. One of the fundamental advantages is adequacy. Automating payroll assessments saves time and effort stood out from manual cycles. By entering laborer information and remittance nuances into the calculator, you can quickly create exact payroll figures without performing complex assessments genuinely.

Accuracy is another major benefit of using a payroll calculator. Manual payroll processing is prone to errors, whether due to miscalculations or incorrect data entry. A payroll calculator eliminates these risks by performing calculations automatically and ensuring that all deductions are applied correctly. This reduces the likelihood of mistakes and helps maintain accurate financial records.

Consistency is a basic part of payroll management. A payroll deductions online calculator ensures that your payroll processes conform to current tax regulations and guidelines. By utilizing a device like a Paycheck Calculator, which reflects the latest tax rates and deduction rules, you can avoid legal issues and potential penalties. This consistency is crucial for maintaining good standing with regulatory agencies and ensuring that employees receive accurate pay.

Choosing the Right Payroll Deductions Online Calculator

While choosing a payroll deductions online calculator for your business, think about your particular necessities and prerequisites. Assess the elements referenced before, like customization, ongoing updates, mix capacities, and ease of use. Furthermore, evaluate the adaptability of the calculator to guarantee it can deal with your business’ current and future payroll needs.

Cost is another factor to consider. While some payroll calculators are available for free, others come with a subscription fee or one-time purchase cost. Weigh the cost against the features and benefits offered to determine if the investment is justified for your business. Consider the potential return on investment in terms of time saved, accuracy improved, and compliance ensured.

Customer support is also an important aspect to evaluate. Choose a payroll calculator that offers reliable customer support to assist with any issues or questions that may arise. Access to timely and effective support can help resolve problems quickly and ensure that you can use the calculator effectively.

Implementing Your Payroll Calculator

Once you have selected the best payroll deductions online calculator for your business, the next step is implementation. Begin by configuring the calculator according to your payroll structure and deduction requirements. Input employee information, deduction rates, and other relevant data to set up the calculator.

Preparing is fundamental for guaranteeing that your group can utilize the calculator successfully. Give instructional courses or assets to HR experts and payroll chairmen to acclimate them with the device’s highlights and usefulness. Appropriate preparation will assist with expanding the advantages of the calculator and guarantee smooth activity.

Testing the calculator before completely incorporating it into your payroll interaction is critical. Run test computations to check that the apparatus is creating exact outcomes and taking care of deductions accurately. Address any issues or disparities that emerge during testing to guarantee that the calculator proceeds true to form.

Conclusion

Picking the best payroll deductions online calculator for your business is an essential decision that can impact the accuracy and efficiency of your payroll cycle. By considering key components like customization, consistent updates, blend limits, and usability, you can pick an instrument that resolves your issues and further develops your payroll the chiefs. The benefits of using a payroll calculator, including extended efficiency, accuracy, and consistence, make it a critical hypothesis for any business. Proper execution and planning will help you with totally using the calculator’s abilities, ensuring that your payroll cycle is streamlined and reasonable.

In rundown, a very much picked payroll deductions online calculator can essentially further develop your payroll the board, furnishing exact computations and guaranteeing consistence with guidelines. Carve out opportunity to assess your choices and select an instrument that lines up with your business needs, and you’ll receive the benefits of a more proficient and precise payroll process.