This story originally appeared on Best Stocks

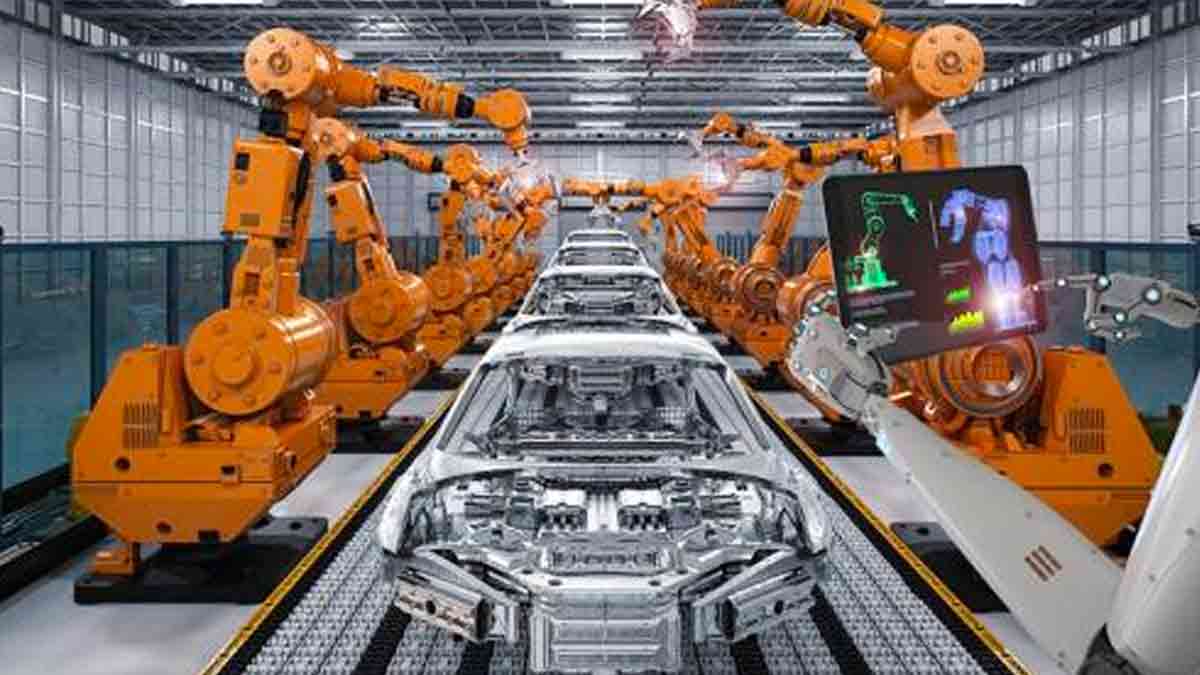

Industrial stocks are stocks that focus on the production of products that have a direct impact on the economy. These industrial stocks can offer a number of different benefits to investors. For example, it can provide you with insight into the industry’s future as a whole, which can help you better understand how it will respond to economic conditions. Additionally, industrial stocks can give investors a better understanding of how companies are doing financially, which can help them make better investment decisions. As a consequence, industrial stocks may be a suitable alternative for investors looking to get a broad view of the stock market.

The global economy’s dorsum is the industrial sector. It provides jobs and a stable manner in which the rest of the economy can function. This sector includes manufacturing, transportation, construction, retail, and insurance. Industrial companies might have a good relationship with the government, and a strong government is essential for industrial businesses to thrive.

Here we’ll provide you with a comprehensive guide to the best industrial stocks to buy now for investors. We’ll look at the different types of industrial companies, their benefits, and how to invest in this market. We’ll also provide you with our recommended strategies for finding and investing in these stocks.

What are industrial stocks?

Industrial stocks are securities that focus on the production, distribution, and sale of goods and services in the manufacturing, transportation, and energy industries. These stocks can be helpful when investors are looking to invest in companies with strong financial prospects and opportunities.

Industrial can be the best stocks to buy now because it can give investors the opportunity to gain exposure to a company that is likely to be successful and can also offer you the opportunity to make money even though the stock falls. However, it is important to know that Industrial stocks tend to be more volatile than other types of stocks.

The stock should always be from a reliable company, have a strong history of meeting production goals and experiencing consistent growth, and have been well invested in by others and not just bought and sold by someone looking for a fast return on investment. Finally, the company’s management should be reputable and have a good track record of success.

Many industrial companies have substantial competitive advantages that make it difficult for competitors to overtake. However, other companies are located in difficult-to-market areas, leading to limited sales and profitability. Finally, it is often difficult to predict future business trends and results, so it is essential to do your research before investing in industrial stocks.

Types of Industrial Stocks

Transportation and Logistics services

Transportation and logistics services are the ability to move goods and people across borders quickly and efficiently. It includes everything from shipping container transportation to air transport. These services are essential for businesses of all sizes, including small startups, big corporations, and governments.

Transportation and logistics services are a critical part of any business because it helps make the business run smoothly, playing an essential role in your global competitive advantage. It is responsible for managing all aspects of freight transportation, including passenger transportation, cargo carriage, and transfer services.

The transportation and logistics sector can be broken down into two main categories: on-demand and demand-based. On-demand transportation refers to transportation that is provided by the business itself, such as shipping containers or air cargo. Demand-based transportation is requisitioned by a customer or client, such as airport pickups or car rentals.

The benefits of using transportation and logistics services vary depending on the size of the business and its needs. For small businesses, on-demand transportation can be faster and cheaper than demand-based transportation. On the flip side, larger companies may find demand-based transportation more expensive and time-consuming than on-demand transport.

The sector can transport goods, products, or people from one location to another, manage transportation costs, provide access to essential supplies and equipment for businesses; customer service, and maintain the infrastructure needed for high-volume, long-term operations.

In recent years, the transport and logistics sector has seen increased inactivity. This projection is due to many factors, including the growing trend for travel, the need for new transportation infrastructure, and the rise of e-commerce. In addition, it plays a critical role in providing goods and passengers with safe and efficient journeys.

Aerospace and defense

The Aerospace and Defense Industry is the world’s leading manufacturer and supplier of advanced aerospace and defense systems. It offers a wide range of products, including fighter jets, missiles, warships, tanks, and other armored vehicles.

The importance of the industry is in the fact that it produces goods that are used in military and security systems. All around the world, some companies manufacture aerospace and defense products. Lockheed Martin, Boeing, Raytheon, Northrop Grumman, and EADS are the most important companies in the field.

The sector products are used in many countries worldwide and have been providing high-quality aerospace and defense systems to the global market for many years.

The Aerospace and Defense sector has a significant impact on national security. It provides critical goods and services to the military, government agencies, commercial entities, and other sectors. In 2021, the industry generated $874 million in value-added worldwide. It is a large and rapidly growing industry with a variety of capabilities.

Construction equipment and building supplies

Construction equipment and building materials are a constantly expanding sector. As a result, demand for construction equipment and building supplies continues to grow, pushing down prices. This has resulted in a boom in the business in recent years, with multiple companies fighting for market dominance.

Many companies have created its brands to keep up with the competition. Some brands offer high-quality products at affordable prices, making it perfect for construction projects. In addition to providing excellent products, these brands also have a strong history of customer service. From customer support during sales meetings to returning products after purchase, these companies ensure that their customers are happy and satisfied.

The construction industry is also in charge of developing, producing, and putting these machines in place. As a result, there is a wide range of construction equipment and building materials on the market. Bulldozers, mowers, saws, generators, excavators, and other sorts of construction equipment are among the most frequent. Each piece of construction equipment has its own set of advantages and disadvantages.

These days, construction businesses, whether helping clients build single-family homes or skyscrapers, rely on industrial firms to supply the parts and machines that go into making these products. It’s a great deal for both sides: The industrial firm gets to produce high-quality products at a low cost. In contrast, the construction business gets to source materials and equipment at a fraction of the cost of traditional construction companies.

The construction industry is a massive and booming market. It employs more people than the gaslighting industry, and it’s expected to grow by 4.6% in 2022. In fact, according to the National Association of Home Builders, the construction sector creates over 167,800 jobs in the United States each year.

In recent years, the construction industry has seen a renewed interest in sustainable building practices and the use of renewable energy sources. As a result, some of the leading companies in this field are moving towards a more sustainable approach by manufacturing items and machines to construct its built environment.

Manufacturing and distributing capital goods

Capital goods are items that are not utilized right away but are instead saved and utilized later. It may range from automobiles to computers. When it comes to capital goods, the most essential thing is to ensure that it is produced on time and at a cheap cost so that profits may be generated.

Capital goods companies are responsible for building the equipment used to produce other goods. This includes tooling and fabricating equipment, presses, and boilers. By building these machines and equipment, capital goods companies help keep production costs low and increase efficiency. Additionally, by constructing these machines and equipment, capital goods companies can help to create new products and services.

There are two types of capital goods when it comes to manufacturing: fixed capital and variable capital. Fixed capital refers to things like machines and plants. It can be invested in making products that will last for a long time, like cars or computers. Variable capital refers to things subject to change, like jobs or markets. It can be invested in producing products that will vary in price, like food or clothing.

This difference is essential when it comes to financing a company. Fixed capital can be funded with money from investors, while variable capital must be financed with debt. This difference affects a company’s financial stability and its ability to operate in the market.

In the past, capital goods were produced in large quantities and distributed through a provider network. Nowadays, capital goods are made in small amounts and are distributed through a network of buyers. This change has several consequences for the manufacturing sector. One consequence is that it is now more difficult to produce capital goods in large quantities. The second consequence is that it is now more difficult to distribute capital goods through a network of providers. The third consequence is that it is now more difficult to find buyers for capital goods.

Lately, there’s been a lot of discussion about the best way to invest in capital goods stocks. Some people believe that these stocks are a great way to generate high returns while preserving a low risk. However, others argue that capital goods stocks have little potential for returning high returns and are better suited for more aggressive investors looking for higher yields.

Pros and Cons of investing in Industrial Stocks

Advantages of Investing in Industrial Stocks

There are a few key things to keep in mind when it comes to industrial stocks. First, companies involved in heavy industries (such as steel and aluminum) often have solid roots and a long history in the industry. This makes it a good candidate for investment, as investors can generally trust their business practices and intentions. Second, industrials tend to be well-diversified – which means it has a wide range of assets and liabilities, making ita good fit for riskier investments.

Industrial stocks have been a crucial part of the U.S. economy for centuries, and it will continue to be so in the coming years. Industrial stocks are primed for continued success with technological advancements and strong economic growth. Here are five reasons why:

- Industrial stocks are a good investment because it are well-positioned to benefit from future technological advances.

- It is often volatile, making it an excellent option for risk-averse investors.

- It has low overhead costs, making it more affordable to operate than other types of stocks.

- It is a good representation of the companies that make up the U.S. economy.

Risks of Investing in Industrial Stocks

There has been a resurgence of interest in industrial stocks in recent years. This is because industrial stocks offer opportunities for investors to gain exposure to companies that have a strong future and are well-positioned to succeed. However, there are some risks associated with investing in industrial stocks.

One risk is that the stock market could go into a downward spiral. This could happen if the company goes bankrupt if a global recession or increased competition hits the industry. Another risk is that the stock market could become unstable. This could happen if the company has low-priced assets, fails to meet its expectations, or another company buys it. Finally, there is the risk of investing in a stock that is not well-liquid.

Industrial stocks are sometimes subject to political risk. The companies in these stocks may be unable to meet financial goals or face other challenges that could lead to their bankruptcy. This can have a negative impact on the stock prices of these companies, and it can also lead to investors losing money.

Economic dependence could be risky. For example, a country that is dependent on a particular industry may not be able to withstand a recession or other financial crisis. This could lead to social unrest and loss of jobs.

Best industrial Stocks to Buy Now

FedEx (FDX)

Mkt cap: $58.67 B

Trading at: $225.93

FedEx is a transportation company that helps businesses and individuals move products and materials. It operates in more than 220 countries and has a customer base of over 150,000 businesses. FedEx also offers various services, including air cargo, shipping, and logistics. The company’s history goes back to 1971, when the first truck shipment from St. Louis was made to Cincinnati. In 2001, FedEx became a public company and was traded on the New York Stock Exchange. FedEx announced that it would merge with DHL to create its largest truck transporter and logistics firm. Lately, FedEx announced it would connect with China Express (CHINAEX). The merger will create the world’s largest express delivery service.

FedEx offers its customers a variety of shipping options, including air, sea, and ground shipping. FedEx also provides customer service and delivery tracking for its shipments.

Waste Management (WM)

Mkt cap: $6647B

Trading at: 154.50

Waste Management Inc is a waste management, comprehensive waste, and environmental services firm that was created in 1968. In the tri-state area, the company is the top environmental and garbage disposal company. its clients may choose from a variety of Waste Management In-services, such as:

-Waste Removal

-Environmental Services

-Comprehensive Waste Disposal

Waste management is managing and reducing the amount of waste produced by a company or organization. Waste management can take many different forms, but it usually refers to the organization’s management and disposal of waste.

3M (MMM)

Mkt cap: $81.62B

Trading at: $145.51

3M is a leading supplier of materials for the manufacturing and construction industry. Their products are used in a variety of industries, including transportation, manufacturing, and construction. In addition to their products, 3M has developed a range of services that support their customers. These services include customer support, training, and warranty services.

3M is a company that has been in business for almost 100 years. It is known for its textiles and plastics products. The company’s products are used in a variety of industries, including transportation, the military, and construction. In addition to its textiles and plastics products, 3M also manufactures a variety of adhesives and coating materials.

Trex Company Inc (TREX)

Mkt cap: $8.66B

Trading at: $77.35

Trex Company Inc (TREX) is a manufacturer of wood products. The company produces a wide range of wooden products, including furniture, cabinets, floors, and more. TREX is headquartered in Mississauga, Ontario, and its products are distributed in North America and Europe.

The company was founded in 1984 by the current owner, Roger Trex. Roger has over 20 years of experience in the wood industry and has developed a strong reputation for his high-quality products. TREX produces a wide range of different wood species and colors, making it an ideal choice for various applications. The company also offers a wide range of customer service options, making it easy to get help with any questions you may have about their products.

Louisiana-Pacific Corp (LPX)

Mkt cap: $6.01B

Trading at: $70.22

Louisiana-Pacific Corp. is a building solution provider that meets the demands of builders, remodelers, and homeowners. The company is specialized in designing, installing, and maintaining building systems for both public and private purposes. It offers a wide variety of services, including but not limited to: roofing, framing, wiring, thermal insulation, windows, and door installation; chimney installation; electrical wiring and installation; waterproofing; and more.

The company offers a wide range of products and services to meet the needs of its customers, including homes, businesses, schools, and other buildings. Louisiana-Pacific Corp. also has an extensive history in the construction industry, having been founded in 1973. Today, the company is headquartered in Nashville, Tennessee, and is involved in a number of industries, including real estate, infrastructure development, and manufacturing.

Copa Holdings S.A. (CPA)

Mkt cap: 3.25 B

Trading at: $77.88

Copa Holdings SA is a provider of airline passenger and cargo service headquartered in Panama City. The company provides air travel, container shipping, and other transportation services to the local and international market. It holds a portfolio of interests in airlines, shipping companies, and other businesses. Copa Holdings S.A. is the parent company of Iberia Airlines S.A., Copa Airlines S.A., and Copa Canarias S.A.

The company provides air travel, luggage, and cargo services to airlines, Terminals, and Shippers throughout the Americas. In addition to its core airline Passenger and Cargo service, Copa Holdings S.A. offers a variety of additional services that support the aviation industry. These services include:

– A third-party logistics company that specializes in handling heavy freight

– A third-party logistics company that specializes in handling heavy freight Air Transportation Solutions

– A division of Copa Holdings S.A. that provides passenger air transportation services

– A division of Copa Holdings S.A. that provides terminal services at various airports

– A division of Copa Holdings S.A. that provides terminal services at various airports, Shipper Solutions

– A division of Copa Holdings S.A. that focuses on providing shipper solutions for airlines and terminals

Seaboard Corp (SEB)

Mkt cap: $4.57B

Trading at: $3,978.90

Seaboard is a global agribusiness that specializes in seafood marketing and sales. The company’s six core businesses are pork production, trading, retail, ocean transportation, and distribution. Seaboard’s seafood businesses account for more than 94% of its total sales.

SEB is headquartered in Merriam, Kansas, and has over 45 countries. The company has a staff of more than 23,000 people. SEB’s subsidiaries include the Seaboard Foods, Seaboard Marine, Seaboard Overseas & Trading Group (SOTG), Tabacal Agroindustria, Transcontinental Capital Corporation, Ltd. (TCCB), and Mount Dora Farms

Robert Half International Inc. (RHI)

Mkt cap: $12.63B

Trading at: $114.87

Robert Half International global human resource consulting firm based in Menlo Park is a specialized staffing and recruitment company with over thirty years of experience. It provides top-tier staffing for various industries, including legal, business, healthcare, and technology.

From management, sales, marketing, and technical support to strategic planning and customer service,its team has the experience and expertise to provide for other businesses with the perfect job. It takes pride in being one of the most complete staffing firms in the US.

Builders FirstSource Inc. (BLDR)

Mkt cap: $13.22B

Trading at: $ 75.02

Builders FirstSource, Inc. is a Fortune 500 company manufacturing and supplying building materials since 1998. The company offers a wide range of products designed to meet the needs of architects, builders, engineers, construction managers, and homebuilders. Its products include masonry blocks, foundation stones, bricks, blocks and tiles, roofing and siding materials, window frames and doors, and more. Builders FirstSource also offers a wide range of services such as engineering consulting, product installation, construction management, and sales and marketing.

The company offers its customers a wide variety of products to choose from, and it always works to meet the needs of its customers. The company’s goal is to provide its customers with the best possible service and product and make sure that it is continuously working to improve its business.

Carlisle Companies Inc. (CSL)

Mkt cap: $13.22B

Trading at: $75.04

Carlisle Companies is a diversified American corporation that creates, manufactures, and sells a wide range of goods to clients in various niche sectors. The company offers a variety of products that appeal to a wide range of customers, including businesses. Its products are made in the USA, and its values are based on customer satisfaction and innovation.

Carlisle Companies provides innovative technology solutions to federal, provincial, municipal, and international organizations. With a history dating back to 1967, CSL offers a wide range of products and services that help organizations solve their most important business challenges.

Bottom Line

Industrial stocks are a type of investment that focus on the companies that produce goods and services that have a significant impact on society. Industrial companies are typically seen as investments with the potential to make a lot of money, but it can also be risky.

Some industrial stocks tend to be more volatile than others, and can be more difficult to predict than other types of stocks, tending to be more volatile than the stock market as a whole.

Investing in the best stocks in the industrial market provides investors with the opportunity to gain exposure to companies that are involved in the production of goods and services.It can be useful for investors who want to invest in companies that have a strong future, as well as those who want to invest in companies that have potential growth.

The possibility of investing in industrial companies and its best stocks to buy now can also be useful to investors who want to create a portfolio that is tailored to their interests.